Imagine having a smart assistant in your bank that works around the clock, understands your needs instantly, and handles complex tasks without mistakes. That’s exactly what AI agents are bringing to banking today.

If you want faster service, safer transactions, and personalized financial advice tailored just for you, learning about AI agents is a must. You’ll discover how these intelligent systems are changing the way banks operate and how you can benefit from this powerful technology.

Ready to see the future of banking unfold before your eyes? Let’s dive in.

Ai Agents Driving Banking Innovation

AI agents are shaping the future of banking. They bring new ways to serve customers and manage operations. These smart programs handle tasks that once needed human input.

Banks use AI agents to speed up processes and reduce errors. They improve customer support by offering quick, personalized answers. AI agents also spot fraud and manage risks more effectively.

Evolution Of Ai In Finance

AI in finance started with simple automation. Early systems could process transactions and generate reports. These tools saved time but had limited decision-making power.

Over time, AI grew smarter. It began analyzing data and predicting trends. This shift helped banks make better choices and offer tailored services. AI moved beyond basic tasks to support complex financial decisions.

From Automation To Agentic Ai

Agentic AI can act independently and solve problems. Unlike traditional automation, it learns and adapts to new situations. This ability makes banks more agile and responsive.

AI agents now handle tasks like investment research, customer onboarding, and fraud detection. They work 24/7 without fatigue. This leads to faster service and fewer mistakes.

Agentic AI also enhances compliance by monitoring transactions in real time. It alerts banks about suspicious activities immediately. This helps protect both banks and customers from risks.

Key Ai Agent Use Cases In Banking

AI agents have become essential tools in modern banking. They improve efficiency and accuracy in many tasks. Banks use AI agents to handle complex operations and deliver better services. This section highlights key AI agent use cases in banking that shape the industry’s future.

Investment Research And Advisory

AI agents analyze vast market data quickly. They identify trends and predict stock movements. These agents provide personalized advice to investors. They help portfolio managers make informed decisions. AI reduces human error and speeds up research.

Fraud Detection And Risk Management

AI agents monitor transactions in real time. They detect unusual patterns indicating fraud. Banks use AI to prevent unauthorized activities. AI agents assess risks and alert staff immediately. This leads to faster fraud response and less loss.

Customer Service Automation

AI-powered chatbots handle common customer questions 24/7. They offer instant responses without waiting times. AI agents assist with account info, payments, and more. This improves customer satisfaction and lowers operational costs. Human agents focus on complex issues.

Credit Risk Assessment

AI agents evaluate loan applications using multiple data points. They analyze credit history, income, and spending habits. This helps banks decide on loan approvals faster. AI reduces bias and improves risk accuracy. It ensures safer lending practices.

Payment Processing And Transaction Management

AI agents automate payment approvals and settlements. They verify transaction details and flag suspicious activities. These agents speed up processing and reduce errors. Banks use AI to manage large volumes of transactions efficiently. This improves cash flow and customer trust.

Benefits Of Ai Agents For Banks

AI agents bring multiple benefits to banks, changing how they operate and serve customers. These intelligent systems help banks work faster, safer, and smarter. They improve many areas, from daily tasks to complex problem-solving. The result is better service and stronger financial performance.

Enhanced Operational Efficiency

AI agents automate routine tasks, saving time for bank employees. They handle data processing quickly and accurately. This reduces errors and speeds up services like loan approvals and account management. AI agents also monitor systems continuously, catching issues before they grow. Banks can operate smoothly with fewer delays and less manual work.

Improved Compliance And Security

AI agents help banks follow rules strictly and avoid penalties. They track transactions and flag suspicious activity immediately. This lowers the risk of fraud and money laundering. AI systems stay updated with changing regulations and apply them consistently. Banks strengthen their security and protect customer data better.

Personalized Customer Experiences

AI agents analyze customer data to offer tailored advice and products. They respond quickly to questions via chatbots or voice assistants. Customers get relevant financial tips and alerts suited to their needs. This personal touch builds trust and loyalty. Banks can engage customers more effectively and improve satisfaction.

Cost Reduction And Revenue Growth

AI agents cut costs by reducing manual work and errors. Banks save money on operations and compliance. At the same time, AI helps identify new business opportunities. It supports smarter marketing and customer targeting. This leads to higher sales and better profit margins. Banks balance lower expenses with growing income.

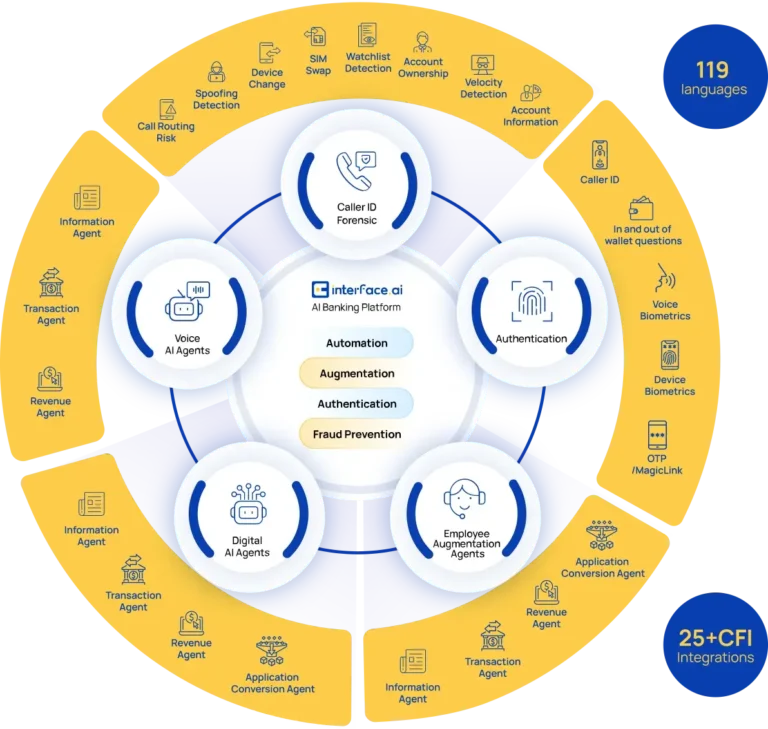

Integration With Core Banking Systems

Integrating AI agents with core banking systems enhances banking efficiency. This integration allows AI to work directly with essential banking operations. Banks gain improved accuracy and faster service delivery. It also supports better decision-making through data-driven insights. AI agents become an essential part of the banking infrastructure. They help automate tasks and support customer interactions smoothly.

Seamless Workflow Orchestration

AI agents coordinate tasks across various banking modules without disruption. They manage workflows by connecting different banking processes automatically. This reduces manual effort and errors in daily operations. AI ensures that transactions, approvals, and updates follow the correct sequence. Banks experience smoother operations and faster processing times.

Real-time Data Access

AI agents access updated banking data instantly from core systems. This real-time data improves the accuracy of AI predictions and responses. Banks can detect fraud, assess risks, and approve loans faster. Customers receive timely information about their accounts and transactions. Real-time access helps banks stay competitive and responsive.

Multi-channel Interaction Support

AI agents support interactions across multiple customer channels like chat, phone, and apps. They provide consistent service, regardless of the platform used. Customers enjoy quick responses and personalized assistance anytime. Integration with core systems ensures AI agents have all needed information. This enhances customer satisfaction and loyalty in banking.

Challenges In Implementing Ai Agents

Implementing AI agents in banking is promising yet complex. Banks face several challenges that slow down AI adoption. These obstacles range from protecting customer data to meeting strict rules. Understanding these challenges helps banks plan better and avoid costly mistakes.

Data Privacy And Security Concerns

Banking data is sensitive and valuable. AI agents need access to large data sets to work well. Protecting this data from breaches is a major concern. Banks must ensure AI systems follow strict security rules. Any data leak can damage trust and lead to heavy fines. Continuous monitoring and strong encryption are necessary to keep data safe.

Regulatory Compliance

Banks operate under strict laws and regulations. AI agents must comply with these rules at all times. Regulations vary by country and can change often. Ensuring AI systems meet these requirements is difficult. Banks need clear guidelines and regular audits. Failure to comply can result in penalties and legal issues.

Technology Adoption Barriers

Integrating AI agents into existing systems is not simple. Legacy banking systems may not support new AI technologies. High costs and long timelines slow down adoption. Resistance from staff and customers also creates barriers. Banks must invest in infrastructure upgrades and change management. Smooth integration is key to success.

Talent And Skills Gap

Skilled professionals in AI and banking are rare. Hiring and training staff to manage AI agents is challenging. Banks compete with tech companies for top talent. Lack of expertise can cause project delays and errors. Continuous learning programs and partnerships help bridge the skills gap. Building a strong AI team is essential for growth.

Future Of Ai Agents In Finance

The future of AI agents in finance points to smarter, faster, and more efficient banking. These intelligent systems will handle complex tasks with minimal human input. They can learn, adapt, and make decisions independently. This shift will enhance customer experiences and streamline banking operations. Banks will use AI agents to boost accuracy and reduce costs. The technology will evolve to become an essential part of finance.

Agentic Ai Advancements

Agentic AI refers to systems that act independently to reach goals. These AI agents can analyze data, make decisions, and execute tasks without human help. They improve over time through learning from new information. Banks use agentic AI to automate loan approvals, detect fraud, and manage risks. These advancements reduce errors and speed up service delivery. Agentic AI will grow more sophisticated, handling broader financial duties.

Impact On Retail And Commercial Banking

AI agents will transform both retail and commercial banking sectors. For retail customers, AI offers personalized advice, 24/7 support, and faster transactions. Commercial banks will benefit from AI-driven credit assessments and cash flow management. AI agents help detect unusual activities, enhancing security for all clients. The technology allows banks to serve customers better while cutting operational costs. Banking will become more accessible and efficient for everyone.

Role In Open Banking And Fintech Collaboration

AI agents play a key role in open banking and fintech partnerships. They facilitate secure data sharing between banks and third-party providers. This enables new financial services and products tailored to customer needs. AI agents help monitor transactions and ensure compliance with regulations. Fintech firms use AI to innovate and offer better financial tools. Collaboration powered by AI agents will drive the future of finance.

Leading Banks And Ai Agent Success Stories

Leading banks have embraced AI agents to improve their services and operations. These smart systems help with complex tasks quickly and accurately. They bring benefits such as better research, faster collections, and stronger support for staff. Real examples show how AI agents change banking for the better.

Jp Morgan’s Ai Agent For Investment Research

JP Morgan created an AI agent to help with investment research. It scans vast amounts of data to find useful insights. Analysts save time by focusing on key information the AI highlights. This agent improves decision-making and speeds up research processes. It also reduces errors from manual data handling.

Ai Agents Enhancing Collections

Banks use AI agents to improve debt collections. These agents analyze customer data to predict payment behavior. They suggest the best way to contact each customer. This approach increases successful collections and reduces customer frustration. AI agents help collections teams work more efficiently and fairly.

Frontline Teams Empowered By Agentic Ai

Agentic AI supports frontline bank employees in daily tasks. It provides quick answers and guides through complex procedures. Staff handle customer questions faster and with more confidence. This technology helps improve customer satisfaction and staff productivity. Frontline teams become more effective with AI assistance.

Frequently Asked Questions

What Are Ai Agents In Banking?

AI agents in banking are autonomous software programs that perform tasks like fraud detection, customer service, and risk assessment. They use machine learning and natural language processing to improve efficiency and accuracy in banking operations.

How Do Ai Agents Improve Banking Security?

AI agents analyze transaction patterns and detect unusual activities in real-time. This helps prevent fraud and unauthorized access, enhancing overall banking security and protecting customer data.

Can Ai Agents Personalize Customer Banking Experiences?

Yes, AI agents tailor banking services by analyzing customer data and behavior. They offer customized product recommendations, personalized financial advice, and faster support, improving customer satisfaction.

What Tasks Can Ai Agents Automate In Banks?

AI agents automate tasks such as loan processing, compliance checks, transaction monitoring, and customer inquiries. This reduces manual work, speeds up processes, and lowers operational costs.

Conclusion

AI agents are changing how banks serve customers daily. They speed up tasks and reduce errors effectively. Banks save time and money by using these smart helpers. Customers enjoy faster responses and tailored support. Security also improves with AI monitoring risks closely.

As technology grows, AI agents will become even smarter. This shift helps banking become more user-friendly and efficient. Embracing AI agents today sets the stage for future success. The banking world is ready for this steady change.